Offshore Trust – A Powerful Tool for Asset Protection and Anonymity

Offshore Trust – A Powerful Tool for Asset Protection and Anonymity

Blog Article

Checking out the Advantages of an Offshore Trust for Wide Range Protection and Estate Preparation

When it pertains to securing your wide range and preparing your estate, an overseas Trust can supply significant benefits. This strategic tool not only safeguards your properties from creditors but likewise supplies privacy and prospective tax obligation advantages. By understanding exactly how these depends on work, you can customize them to fit your unique needs and values. Yet what particular variables should you think about when establishing one? Let's check out the crucial benefits and considerations that can affect your decision.

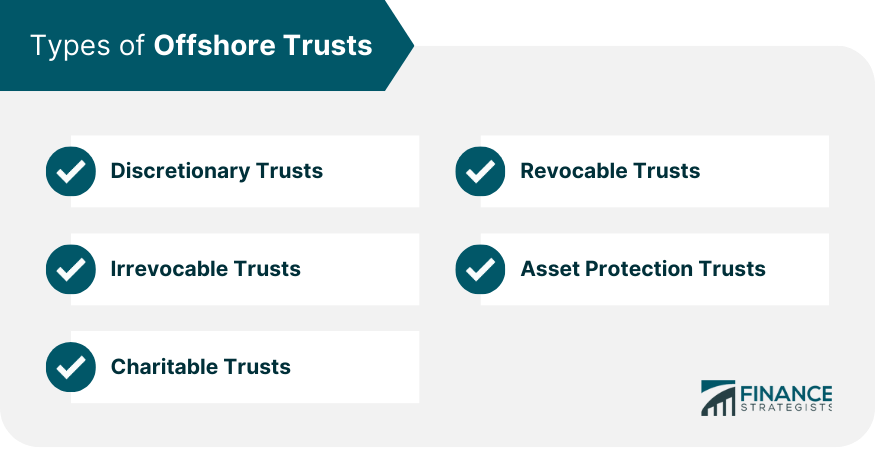

Understanding Offshore Trusts: Definition and Essentials

Recognizing offshore counts on can be important when you're discovering ways to safeguard your wide range. An offshore Trust is a lawful plan where you transfer your assets to a depend on managed by a trustee in a foreign territory. This arrangement uses a number of advantages, including tax obligation advantages and enhanced privacy. You keep control over the Trust while protecting your assets from neighborhood legal cases and possible creditors.Typically, you 'd establish the count on a territory that has desirable regulations, assuring even more robust property security. This implies your riches can be protected from suits or unforeseen financial problems back home. It is very important, however, to recognize the legal effects and tax obligation responsibilities associated with managing an offshore Trust. Consulting with an economic consultant or legal professional is sensible, as they can lead you via the intricacies and guarantee compliance with worldwide regulations. With the ideal technique, an offshore Trust can be an effective tool for guarding your riches.

Asset Security: Protecting Your Wealth From Creditors

When it involves protecting your wealth from financial institutions, comprehending the legal framework of offshore trusts is crucial. These depends on offer significant advantages, such as improved privacy and discretion for your possessions. By utilizing them, you can develop a strong obstacle against prospective claims on your wealth.

Legal Structure Conveniences

While many people look for to expand their riches, securing those possessions from potential creditors is similarly crucial. An offshore Trust uses a durable lawful framework that improves your possession protection method. By developing your Trust in a territory with desirable regulations, you can properly protect your wide range from claims and insurance claims. These jurisdictions usually have solid privacy laws and minimal access for outside parties, which suggests your possessions are much less susceptible to creditor actions. Furthermore, the Trust framework offers legal separation in between you and your assets, making it harder for lenders to reach them. This positive strategy not only safeguards your wealth but also assures that your estate planning goals are satisfied, enabling you to offer your loved ones without undue danger.

Privacy and Confidentiality

Personal privacy and discretion play a critical duty in possession protection methods, especially when using overseas depends on. By developing an overseas Trust, you can maintain your financial events very discreet and shield your properties from potential creditors. This indicates your wealth remains much less accessible to those seeking to make cases versus you, supplying an additional layer of security. Furthermore, lots of territories provide solid personal privacy legislations, ensuring your information is shielded from public analysis. With an offshore Trust, you can delight in the satisfaction that originates from recognizing your properties are protected while maintaining your anonymity. Eventually, this degree of privacy not only protects your riches but also enhances your general estate preparation method, enabling you to focus on what really matters.

Tax Advantages: Leveraging International Tax Obligation Regulation

You're not simply shielding your properties; you're also tapping into worldwide tax obligation incentives that can significantly minimize your tax concern when you consider offshore trusts. By tactically placing your wide range in jurisdictions with favorable tax obligation laws, you can improve your asset protection and lessen estate tax obligations. This technique allows you to enjoy your riches while ensuring it's guarded versus unexpected difficulties.

International Tax Obligation Incentives

As you explore offshore trusts for riches defense, you'll discover that global tax incentives can substantially enhance your financial strategy. Several jurisdictions use beneficial tax obligation treatment for depends on, permitting you to minimize your general tax obligation problem. Certain countries give tax obligation exemptions or reduced rates on earnings produced within the Trust. By purposefully placing your possessions in an offshore Trust, you could likewise gain from tax deferral alternatives, postponing tax obligation obligations up until funds are withdrawn. Additionally, some jurisdictions have no capital gets taxes, which can further improve your financial investment returns. offshore trust. This suggests you can optimize your riches while decreasing tax obligation obligations, making global tax incentives an effective tool in your estate preparing collection

Property Security Methods

Estate Tax Obligation Minimization

Developing an offshore Trust not only secures your properties however likewise provides substantial tax advantages, specifically in estate tax obligation minimization. By putting your wealth in an overseas Trust, you can make use of positive tax obligation legislations in different jurisdictions. Many nations enforce reduced estate tax rates or no inheritance tax in all, allowing you to protect even more of your wealth for your beneficiaries. In addition, because properties in an offshore Trust aren't commonly considered component of your estate, you can better reduce your estate tax obligation responsibility. This critical step can cause significant cost savings, making certain that your recipients obtain the optimum gain from your hard-earned wide range. Eventually, an offshore Trust can be an effective device for reliable inheritance tax preparation.

Personal privacy and Privacy: Maintaining Your Finance Discreet

Estate Planning: Guaranteeing a Smooth Transition of Riches

Maintaining privacy through an overseas Trust is just one element of riches monitoring; estate preparation plays a vital duty in guaranteeing your properties are passed on according to your desires. Effective estate preparation permits you to describe just how your wide range will be distributed, lowering hop over to these guys the risk of family members disagreements or legal obstacles. By plainly defining your intentions, you aid your beneficiaries recognize their duties and responsibilities.Utilizing an offshore Trust can streamline the procedure, as it often provides you with an organized method to handle your assets. You can mark beneficiaries, define conditions for inheritance, and even lay out certain uses for your wide range. This tactical method not only secures your assets from possible creditors however also facilitates a smoother modification throughout a difficult time. Inevitably, a well-crafted estate plan can protect your heritage, providing you satisfaction that your enjoyed ones will be dealt with according to your dreams.

Versatility and Control: Customizing Your Trust to Fit Your Requirements

When it involves tailoring your overseas Trust, versatility and control are key. You can tailor your Trust to fulfill your certain requirements and preferences, ensuring it lines up with your economic goals. This versatility permits you to choose just how and when your assets are dispersed, providing you assurance that your wide here range is handled according to your wishes.You can pick beneficiaries, set problems for circulations, and also mark a trustee that recognizes your vision. This level of control helps secure your possessions from possible dangers, while additionally supplying tax obligation benefits and estate preparation benefits.Moreover, you can change your Trust as your situations transform-- whether it's including new beneficiaries, changing terms, or resolving shifts in your financial circumstance. By customizing your offshore Trust, you not only shield your wealth however additionally develop an enduring tradition that mirrors your goals and values.

Picking the Right Jurisdiction: Aspects to Take Into Consideration for Your Offshore Trust

Picking the best territory for your overseas Trust can substantially influence its effectiveness and benefits. When taking into consideration options, assume regarding the political stability and regulatory atmosphere of the country. A stable jurisdiction minimizes dangers related to abrupt lawful changes.Next, review tax ramifications. Some jurisdictions use tax obligation motivations that can improve your riches defense technique. Additionally, consider the legal structure. A jurisdiction with solid possession defense legislations can guard your properties versus potential claims - offshore trust.You must additionally show on personal privacy guidelines. Some nations give better privacy, which can be vital for your comfort. Analyze the availability of neighborhood experts who can aid you, as their experience will certainly be crucial for managing the intricacies of your Trust.

Often Asked Questions

What Are the Prices Related To Developing an Offshore Trust?

When developing an offshore Trust, you'll come across costs like configuration costs, continuous administration fees, legal costs, and potential tax obligation ramifications. It's necessary to examine these prices against the benefits prior to choosing.

How Can I Accessibility My Possessions Within an Offshore Trust?

To access your properties within an offshore Trust, you'll generally require to deal with your trustee - offshore trust. They'll direct you via the process, ensuring compliance with guidelines while promoting your demands for distributions or withdrawals

Are Offshore Trusts Legal in My Nation?

You ought to check your nation's regulations pertaining to overseas trust funds, as guidelines differ. Lots of countries enable them, yet it's important to comprehend the legal effects and tax responsibilities to assure conformity and stay clear of potential problems.

Can an Offshore Trust Aid in Divorce Procedures?

Yes, an overseas Trust can possibly assist in separation proceedings by protecting possessions from being split. Nevertheless, it's vital to seek advice from a lawful professional to assure compliance with your neighborhood laws and laws.

What Occurs to My Offshore Trust if I Change Residency?

If you alter residency, your overseas Trust might still stay undamaged, however tax obligation effects and legal considerations can differ. It's essential to consult with an expert to navigate these modifications and warranty conformity with guidelines. An offshore Trust is a legal arrangement where you move your properties to a count on taken care of by a trustee in a foreign jurisdiction. You keep control over the Trust while securing your assets from regional legal cases and prospective creditors.Typically, you would certainly establish the Trust in a jurisdiction that has desirable laws, assuring even more durable possession security. Establishing an offshore Trust not just secures your assets yet likewise uses considerable tax advantages, especially in estate tax obligation reduction. By positioning your properties in an overseas Trust, you're not just protecting them from potential lenders yet likewise ensuring your economic information stays confidential.These depends on run under stringent privacy laws that restrict the disclosure of your monetary information to 3rd events. You can preserve control over your riches while taking pleasure in a layer of privacy that residential counts on often can not provide.Moreover, by using an overseas Trust, you can reduce the threat of identity theft and unwanted scrutiny from monetary establishments or tax authorities.

Report this page